Course Categories

Stock Market Training Online Courses

Total 38 CoursesNSE NCFM Certification Preparation Modules

Total 17 CoursesSEBI NISM Certification Preparation Modules

Total 17 CoursesAccounting and Taxation online courses

Total 5 CoursesMock Test Paper NSE NCFM Certification Course Modules

Total 21 CoursesMock Test Paper SEBI NISM Certification Course Modules

Total 18 CoursesDigital Marketing Online Courses

Total 14 CoursesManagement Skills Development Programme

Total 18 CoursesOnline Computer Courses Training

Total 11 CoursesOnline Language Courses

Total 2 CoursesTop Rated Courses

NIFM Online Classes Is Flexible and Effective

Help the students to learn about various aspects of investment and gain complete knowledge about stock market.

-

Learn from Industry Expert

-

Diverse course offerings

-

Interactive learning experiences

-

Up-to-date content

experience

Benefits From Our Online Learning

Video Tutorial

Watch comprehensive video tutorial available in the online course to enhance your learning experience.

E-Books

Access detailed eBooks in the online course to deepen your understanding of the topics.

Mock Test & Certification

Take mock tests and earn certifications through the online course to validate your skills and knowledge.

Preparation for NCFM & NISM Exam

Prepare for NISM and NCFM exams with video tutorials, eBooks and practice tests in the online course.

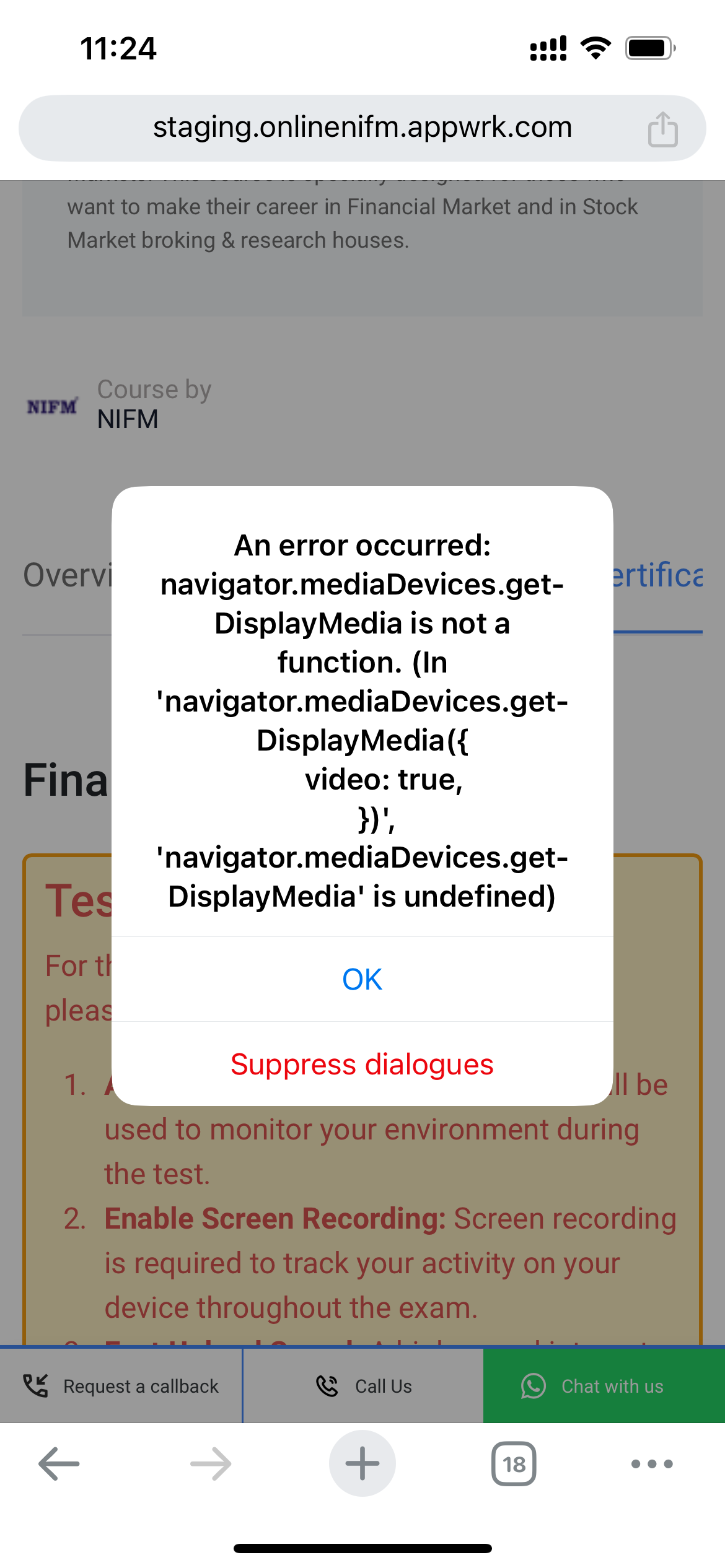

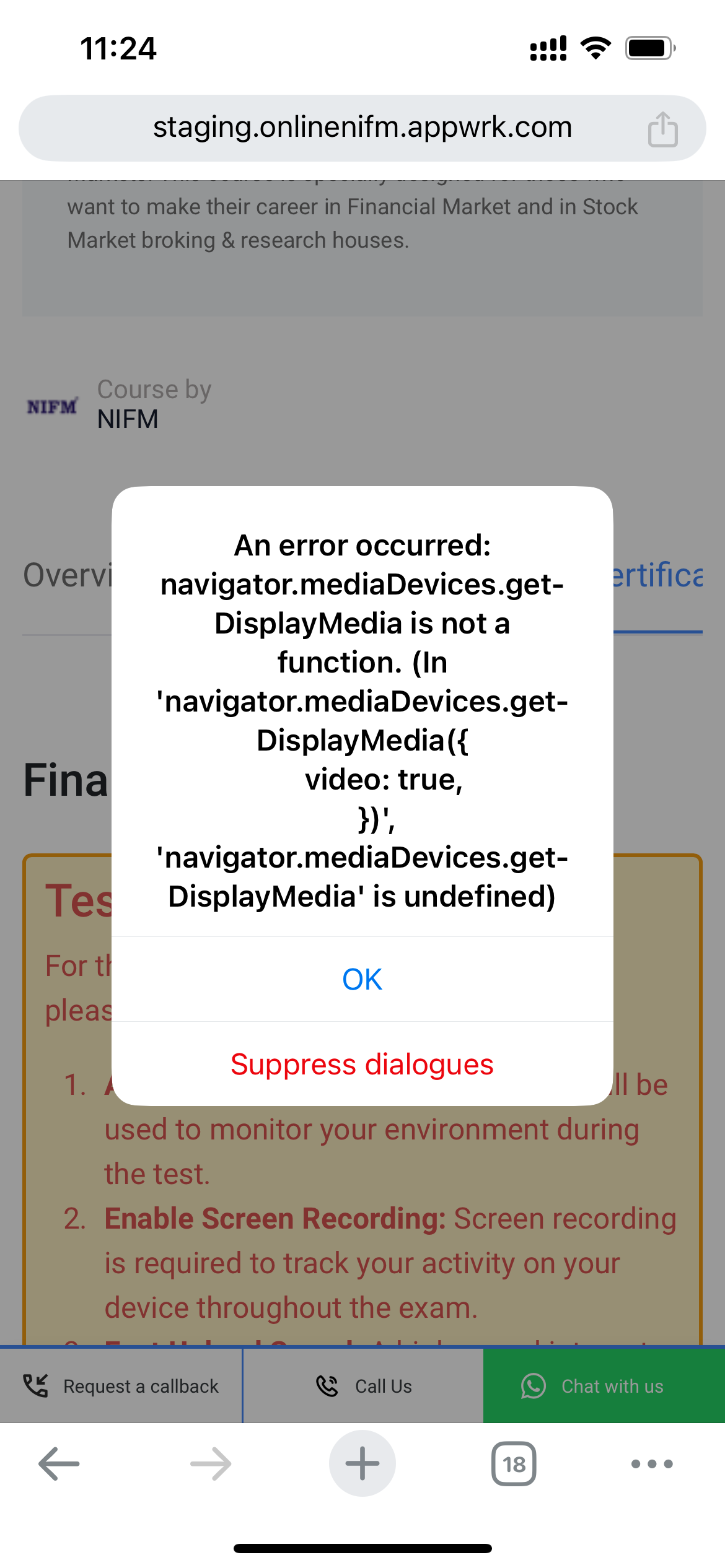

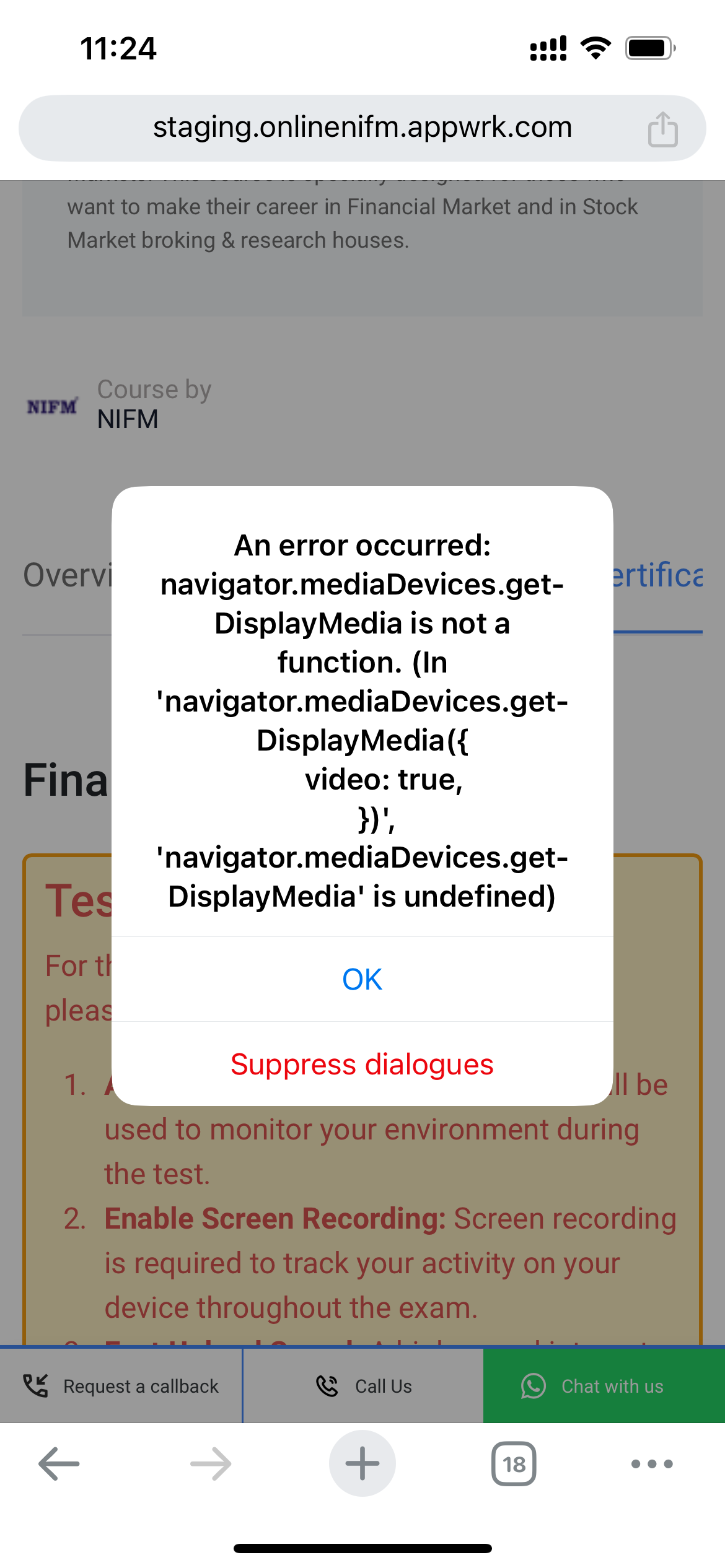

Proctored exams for corporates

Proctored exam facilities are available on demand, specially designed for corporates.

Newly Added Courses

Test Live Course 1

Stock Market Trading Courses & Accounting Taxation Classes. Best training institute for GST & NISM course classes.

Live Course Class

Arbitrage Trading Course

Arbitrage Trading Course is the best online course to became a professional Arbitrage trader in all segments of stock market

Mind Controlling Program Level-1 in Stock Market Trading

NIFM Mind Controlling Program Level – 1. The Great Budha said:- If a man conquers in battle a thousand times, and If another conquers himself, the latter man is a greater conqueror.

Free Demo Course

Free Demo Course is available to check how you will get access to online course and what features are available in online courses.

Mind Controlling Program Level-2 in Share Market Trading

Mind Controlling Program Level-2 is specialized for STOCK MARKET Traders and Investors. This Program will help to control our mind while making trades in share market.

On Dance Floor in 7 Days Crash Course for Beginners

Learn Dance in 7 days with online videos on bollywood dance style, hip-hop and contemporary dance crash course at home on online lessons on dance training classes for beginners.

Mock Test Insurance Module NCFM Certification

Online Mock Test for Insurance Module NCFM certification with complete question bank as per NSE pattern

Mock Test Equity Research Module NCFM Certification

Mock Test NCFM Equity Research Module Certification examination with complete question answers test papers as per NSE pattern

Mock Test Merchant Banking Certification Course NISM Series IX

Mock Test Merchant banking certification Module NISM Series IX certification with complete question bank as per NSE pattern

Diploma in Digital Marketing

Best online diploma course on Digital Marketing training. Complete pre-recorded videos with 12 months validity.

Mock Test Corporate Governance Module NCFM certification

Mock Test NCFM Corporate Governance Module with complete question bank and as per NSE pattern

Mock Test NISM Series XII Securities Markets Foundation

This examination is a voluntary examination. The NISM-Series-XII: Securities Markets Foundation Certification Examination is for entry level professionals, who wish to make a career in the securities markets. This certification examination will also be useful to all those individuals who are interested in acquiring a basic knowledge of the Indian Securities markets, including:

Top 10 Profit Making Secret Trading Strategies for Equity

Every trader have its own strategy or theory to make his/her trade in equity market. This course contains strategies used by specialized traders in market.

Certified Accounts Professional

Certified Accounts Professional is the best online short term certificate course to become junior accountant.

Amazon Seller Course

Amazon Seller online course is the best training program to learn how to sell products on Amazon offered by NIFM institute.

Canva Graphic Designing Course

Canva Graphic Designing online course is the best easy course to became a graphic designer offered by NIFM institute.

Certificate Course in Financial Modeling

Certificate course in Financial Modeling helps to calculate the value of a share of the company. using MS-Excel and financial statements of a company.

Risk Management Certificate course

Expert Instructor Free Video

Student Reviews

ritesh singh

Derivative Market Dealers Module

Good Faculty

ritesh singh

Derivative Market Dealers Module

Best course of NIFM for investors and traders

ritesh singh

Derivative Market Dealers Module

Good course content

Jenny Puri

Mock Test NSE NCFM Surveillance in Stock Exchanges Module

testinggggg

Jenny P

Mock Test NSE NCFM Surveillance in Stock Exchanges Module

hi

Jenny P

Mock Test NSE NCFM Surveillance in Stock Exchanges Module

testing

Jenny P

Mock Test NSE NCFM Surveillance in Stock Exchanges Module

testing

Parker S

NIFM Certified Smart Investor Course

“Ut pharetra ipsum nec leo blandit, sit amet tincidunt eros pharetra. Nam sed imperdiet turpis. In hac habitasse platea dictumst. Praesent nulla massa, hendrerit vestibulum gravida in, feugiat auctor felis.”

Jenny P

Mock Test NSE NCFM Surveillance in Stock Exchanges Module

testing

Parker S

NIFM Certified Smart Investor Course

Ut pharetra ipsum nec leo blandit, sit amet tincidunt eros pharetra. Nam sed imperdiet turpis. In hac habitasse platea dictumst. Praesent nulla massa, hendrerit vestibulum gravida in, feugiat auctor felis.

Chanchal .

Financial Market Beginners Module

best institute in financial market segment

Shyam Singh

Financial Market Beginners Module

very supportive

Chanchal .

Financial Market Beginners Module

satisfied

Shakati Srikanth

Financial Market Beginners Module

course content is good very informative

Diwakar Vashishth

Financial Market Beginners Module

good material

Mukesh Sharma

Financial Market Beginners Module

fully satisfied

Vrushali Mandhare

Stock Market Trading Beginners Course

I have completed my stock market beginners course! It was full of knowledge! Thanks for the amazing lectures.

Swapnil More

Power of Numbers Theory for Equity and Commodity Trading

"Power of Numbers Theory for Equity and Commodity Trading" online course is Useful for traders/investors,but its selling price (including GST) should be around 7,500 INR.

NEETU DEWANGAN

Free Demo Course

I have found stock"Zicom",this stock price is rs10.50.it is "50 week low" price,i find "doji candlestick patter" then "bullish candlestick pattern" for confermation of bullish trend.i want to known my analysis is right or not?,and this stock "is go up side or not?

Prerna Singh

excellent videos of courses. i got best for my self . Thanx NIFM for such excellent online courses.any person can learn such valuable courses even at distant places also .

Have Some Questions?

Get a free consultancy from our expert right now!

For Online Courses Submit Your Query Through Enquiry Form

News

Trending News

TESTING NEWS POSTING 1

TESTING NEWS POSTING 1

13-Dec-24 04:08PMTESTING NEWS POSTING 1

NEW COURSE LAUNCH

20-May-22 05:31PMADVANCE LEVEL COURSE IN OPTIONS TRADING 3 Months Programme Specially designed for options traders Faculty support doubt clearnce facility This course provide traders and investors a ful-fledged knwledge about Options, Options Strategies and Options Greek Also. After completion of this course a student can trade or invest in options market independtly and make their own research . for more details call or whatsapp - 8588868475

HURRY UP GRAB 20 PERCENT DISCOUNT ON ONLINE COURSES

01-Apr-21 05:35PMGRAB! 20% DISCOUNT ON ONLINE COURSES AND MAKE YOUR DREAM CAREER THIS DISCOUNT IS ONLY VALID TILL 7TH APRIL 2021 NIFM Having a wide variety of online courses like trading and investment Job oriented courses Nse and Sebi preparation modules Advance theories for traders and investors and much more.. To get discount code or other information call or watsapp - 8588868475

LEARN HOW TO MAKE PERFECT TRADE OR INVEST

31-Mar-21 03:45PMJOIN! ADVANCE LEVEL OF SMART INVESTOR 100% TRADING AND INVESTMENT PROGRAMME Specially designed for freshers & for those who already working into market but wants to upgrade 3 Months programme Starts from very basic to advance 9 Modules (Smart investor ,Fundamental ,technical ,options ,data anlaysis ,trading rules and startegy ,crude oil analysis ,currency analysis , pivot point) for more information call - 8588868475

learn ! 100% job assitance course

11-Mar-21 02:20PMDiploma In Financial Market Management 100% job assitance 6 Certification Preparation of 4 courses of NSE exam Preparation of 2 courses of SEBI exam DURATION- 6 months fee - 15000 In that course you will get JOB assistance in financial Insitution, broking house , advisory , research house who can do this course ba, b.com , ca, cs pursueing students, traders and investors, 10+2, working professionals

Want to Join a JOB ORIENTED course JOIN!

11-Mar-21 02:22PMAdvance Diploma In Financial Market Management 100% Placement Assistance In this courses we will prepare you for the exam of 10 certification of Nse & Sebi which value are globally this is Multipurpose course which have so many opportunities like JOB, TRADING & INVESTMENT , OWN BUSINESS You will get job in banking sector, financial insitution, broking house, advisory, research houses fee - 25000 duration- 1 yr online course any other info call - 8588868475

Blog

Trending Now

10 Best Trading Strategies to Invest in Stock Market

Certainly! Here are 10 popular trading strategies to consider when investing in the stock market:

Why Basic knowledge is important before Investing or Trading in Share Market

Why Basic knowledge is important before Investing or Trading in Share Market/Stock Market?

How to invest or trade in Indian share market companies

How we can invest in Indian share market. First we how to open demat account with depository and trading account with broker through any broking company and link bank account with demat account.

What is the purpose and career opportunity in stock market

There are many career opportunity in stock market, especially in recent year. This market is getting bigger day by day. People from all background whether science, commerce or arts are showing more interest in stock market. Many are opting to become a financial market participant and work independently and many are opting it as full time career.

Who can invest in stock market?

Investment in stock market is beneficial if you know the level where you have to invest for short term or long term. It is not a tough task for trader just need some study properly, they should analysis about the stock or commodity. then that is sure you will get a good return from the stock market.

Do's and Don't for Stock Market traders

Every trader has to make some trading strategy before trading in the stock market and the most important thing follow that principle rules with discipline.

What is Elliot wave theory?

There are so many trading tools available in the market. You don't need to follow all the available tool otherwise you will be confused. Tools are like Price action, Fibonacci sequence, Elliot waves, Volume etc.

What is geopolitical conditions?

There are so many reasons that may affect the financial market. This is also true that nobody can read or the fundamentals factor. A full-time trader can read all the international and national news.

What is stock exchange and how it works?

An exchange is a platform where a registered member can buy or sell in a company.

What is US Dollar Index?

If you are trading in the stock market you must know the value of dollar index, you will come to know the strength of your country's currency. This index will help you like a indicator.

What is the benefit of Advance Diploma in financial market management?

A short term course which is the best course for job purpose in the financial market. ADFMM course is good for whom, who want to do the job in broking firm, bank, and finance.

Benefits of Technical Analysis Course

Technical Analysis is the best way to generate calls for equity or commodity market for intraday, short term or long term. The best entry levels for selling and buying possible only if you know the technical analysis.

What is Equity market or share market? How it works?

Share market can be very risky if you don’t know where to buy or sell. Which level is best for trading in intraday, short term or long term, how much investment required in stock. How to minimize the risk in share market.

What is short means in financial market?

Selling a stock or commodity in the future market is called short selling when a trader thinking that the securities may fall from in coming days.

Benefits of investing in stock market

Before investing in stock market trader should know which stock or commodity is best for buy or sell. If it is bullish then how much money you have to invest and how long you have to invest in it. Also you should know the best level for buy/sell and the exit levels, how much risk involve in that position you must know.

What is Derivative Market?

A derivative market is a platform where financial instrument whose price is dependent upon or derived from one or more underlying assets.

What is the stock market?

A Stock market is a place where stocks, futures, options and commodities are traded. Buyers and sellers meet on this platform provided by stock exchange through computers. To trade in stock market trader should understand the business, economics, demand and supply, politics etc.

Career in stock market

Kick start your career in stock market with NIFM-National Institute of Financial Market (Delhi). We provide short term and long term courses for fresher and experienced. Who want to improve their knowledge or who want to improve their trading skills.

What is German Factory Order and the importance of data

Economic data are important for market, they are basically indicate about the health of the Economic.

Which indicator or oscillator is best for trading intraday long term short term

Technical indicators are tools that provide to traders an indication about the movement or direction of the stock or commodity. These indicators are generally used as additional information before one takes a decision to buy or sell a share.

What is FOMC and the affect of the data

To handle world market economy 12 members discus on about the health of world economy. They vote in favor or against the decision of Interest Rate Statement, Fed Statement and Monetary Policy Statement.

Benefits of Online Stock market courses

Most important benefits of Online Courses is saving your valuable money and time, You can read any time.

What is Bearish Channel How to trade on this pattern?

A Channel is a price movement which is bound by a lower and upper trend line. You can generate short term call by using chart patterns. Must know about these chart pattern. For detail join NIFM Technical Analysis Course in DELHI / NCR / FARIDABAD / LUKHNOW

Intro about Gann Theory

The Gann theory is based on geometry, astronomy and astrology and ancient mathematics.

What is Average Hourly Earnings m/m and the effect

The US data Average Hourly Earnings is a leading indicator. It is one of the earliest data which is published in a month that is related to producer and consumer inflation.er, leading to consumer inflation and the increased likelihood of interest rate increases. Reduction in labor costs will have the opposing effects.

Fed result summary

The Federal Reserve System, it is also known as the Federal Reserve, and informally as the Fed is the central banking system of the United States. In 1913 it was founded by Congress to provide the nation with a safer, smoother, more flexible, and more stable monetary policy and financial system. Over the years, its role in banking and the economy has expanded."

Brave Choice by Greece voters to reject the terms of an international bailout in Sundays referendum.

"Brave Choice" word used by Greece Prime Minister Alexis Tsipras. Greece voters reject the terms of an international bailout in Sunday's referendum.

What is LME Stock What is the impact of LME stocks on base metals how to read LME stockss

London Metals Exchange is commodity exchange where they deals in metal futures. Lots of metals Contracts on the exchange include aluminum, copper and zinc, lead, nickel. LME stock are very important for base metals trader because their impact high for base metals.

FOMC meet ahead at 11:30

FOMC committee which makes key decisions about interest rates and the growth of the US money supply.

Doji candle pattern and the impact of doji

A doji is a strong reversal candlestick patterns which is occurs in the top or the bottom of the trend.

What is Consumer Price Index (CPI) and the effect of data

Consumer price index is the Change in the price of goods and services purchased by consumers. This Data is High impact data important for the base metals also important for Crude oil and gold.

How to Invest in share market or commodity market?

Do you wanna earn from share market? This is the right time to invest in Finance market like equity, commodity or forex. You need to know how to invest, where to invest, how much invest in this market.

Inventory Special: Crude Oil Technical Outlook

What is Crude Oil Inventory?

Nifty Weekly Technical Outlook

In Weekly chart nifty looking weak for coming days. There is a doji candlestick pattern in the top that is indicating that the nifty looking for coming days.

What is Spinning Tops and the importance of Spinning Tops.

The spinning top candlestick patterns is look like a doji pattern, but in spinning top the body of the pattern will be visible. There will be a good difference between the open and close price.

What is Budget and why it is important

The Budgeting is the process of creating a plan to how to spend your money. Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do.

What is German ZEW Economic Sentiment and the effect of this data?

German ZEW Economic Sentiment data is Important for European market. This is leading indicator which is represent the economic health.

Info about Consumer Price Index (CPI)

Consumer price index is the Change in the price of goods and services purchased by consumers. Highly important for the base metals also important for Crude oil and gold.

What is dragonfly doji?

A Dragonfly Doji is a reversal candlestick pattern, mostly form in the bottom of the trend.

China GDP impact on the market

Today’s china data: Actual >7.3% Forecast 7.2% = Good For Currency.

Simple Moving Average indicator

The SMA is the most popular technical analysis tool used by technical Analyst and traders. The Simple Moving Average (SMA) is mainly help to identify the trend direction as well as used to generate buy and sell signals.

What is Spanish Unemployment Change?

A Spanish unemployment change data is important for Euro data. It is change in the number of unemployed people during the previous month which impact to the Economy or currency.

What is support and resistance in technical analysis?

Support and resistance basically indicate the market range. any breakout of support and resistance market move in that way that's why support and resistance is importance in Technical Analysis.

What is GDP data??

what is gdp data? what is impact of gdp? GDP data is basically used as an indicator which shows about the health of the country.

What is Building Permits data??

It's an excellent gauge of future construction activity because obtaining a permit is among the first steps in constructing a new building.

What is Star Candlestick Pattern means in Gold Chart?

Gold settled with a STAR CANDLESTICK PATTERN in a bottom levels after a small correction.

How to start career in stock market industry

Stock market industry is growing rapidly the growth ratio of this industry is higher than compared to other industries. But our Indian financial industry is struggling for skilled professionals. Anyone can start their career in stock market those having completed their graduation/perusing

Doji Candle in Aluminium in weekly chart, know about doji

The Doji is a very strong reversal candlestick pattern where the opening and closing prices of the stock are the same (or almost the same). Doji candlestick should in the top of the trend or in the bottom of the trend.

Hammer Candlestick Pattern in Crude Oil

Hammer candlestick pattern in a strong reversal single candlestick pattern. After confirmation trader may go long according to hammer criteria.

Benefits of Technical Analysis

Technical analysis is a technique of art and science of the historical market data, price, volume and open interest. TA suggest you the adjact ENTRY & EXIT points also provide you the OVER BOUGHT & OVER SOLD zones.

HSBC Final Manufacturing PMI data impact on market.

Base metals futures edged lower on Tuesday, as weaker Chinese manufacturing data than expected data added to concerns over the health of the world's second largest economy.

Bullion fundamental short term outlook 22.09.2014

Bullion prices slipped to their lowest in more than four years (GOLD) and eight-and-a-half months (SILVER). Trading around 1209$ & 17.40$ an ounce in international.

Zinc weekly outlook (Price moving in an up sloping channel) 01 to 05.09.2014

Zinc September contract has took support at 10 weeks SMA and reversed nicely. Prices are moving nicely in an up sloping channel.

Head & shoulder Pattern in Rcom 26.08.2014

Rcom trading on a negative bias these days....there is a Head & Shoulder chart pattern on Daily Chart.

FOMC main points 21.08.2014

Information received since the Federal Open Market Committee met in June indicates that growth in economic activity rebounded in the second quarter.

Gold short term outlook 19.08.2014

Gold opened with a gap and traded with negative bias. Commodity has settled below its 10 days SMA and now getting support at 20 weeks SMA that stands near 28218.

Aluminnium OverBought on Stochastic 12.08.2014

Aluminium Overbought reading on stochastic hints a possible trend reversal from key resistance zones of 124-127 zones.

Bearish Harami Candlestisk pattern on Zinc Chart 07.08.2014

Zinc was also influenced by bearish harami candlestick pattern and bearish cross on MACD indicator and settled just above the 10 days SMA.

Silver Technical Outlook for short term 5.8.2014

Silver settled with negative note. Silver has fallen below 10 and 20 days SMA and 10 days SMA has also fallen below 20 days SMA and indicates a retest to 50 days SMA that stands near 43600 zones.

Natural Gas Weekly Technical Outlook 28.07.2014

Natural gas July contract inched 10.70 rupees down to settle at 227.10. We have seen a major trend line violation in this commodity and now commodity is heading towards next barrier for bears that stand near 220 zones.

Lead Doji Candlestick formation on EOD 23.07.2014

Lead Daily EOD chart shows doji candlestick formation along with contracting MACD hints weakening bullish momentum.

Aluminium Technical Outlook for intraday 22.07.14

Aluminum July contract settled at 121.35 down by 2.65 rupees. Aluminum has settled well above key resistance of 120 and indicates more bullishness.

Zinc Weekly Technical Outlook 14-07-14

Zinc July contract inched 4.45 rupees up to settle at 137.95 this week. Zinc has recently closed well above the resistance line of symmetric triangle and horizontal resistance of 137 indicates more bullishness.

Copper Technical Shooting Star 09.07.2014

Copper Yesterdays session was a volatile session for this counter and it settled with a shooting star candlestick formation just nearer the 200 days SMA on daily continuation chart.

Aluminium Shooting Star Pattern on Daily Chart 4-07-2014

Aluminum July contract settled at 114.40 up by 0.25 rupees. Aluminum headed an intraday high of 115.10 for the day but could not hold above 115 and settled with a shooting star like candlestick formation.

Gold Technical Outlook (Spinning top pattern) 23.06.2014

Gold August contract on MCX inched 57 rupees up to settle at 27668. Gold traded with narrow range for the day and settled with a spinning top candlestick pattern that indicates a state of indecision among bulls and bear

Lead Bullish Harami pattern on Daily Chart 16.06.2014

Lead on MCX settled at 124 up by 2.05 rupees. Lead could not continue falling and settled with a bullish harami candlestick pattern indicating presence of buying forces in this counter.

Aluminium bearish harami candlestick pattern on daily chart 11.06.2014

Aluminum June contract settled at 111 down by 1.70 rupees. Metal traded with a bearish note and settled with a bearish harami candlestick pattern.

Crude Oil Bullish Harami Pattern ON DAILY CHART 04.06.2014

Crude oil June contract on mcx inched 29 rupees down to settle at 6093. Crude oil traded in narrow range and settled within the trading range of prior session that makes it a bullish harami pattern.

Aluminium Technical Outlook 22.05.2014

Aluminum May contract settled at 102.05 up by 5 paisa. Aluminum bears don’t have enough power to breach 101 levels and hovering near the same. Oversold reading on stochastic indicator hints a possible recovery.

Bearish Engulfing Pattern signaling in Natural Gas for short

Natural gas closed just nearer the previous lows forming bearish engulfing pattern may trigger some weakness.

Bullish engulfing candlestick pattern in Zinc 5.5.2014

Nice recovery has taken place in Zinc from key support of 122 and metal closed with a bullish engulfing candlestick pattern.

3 black crows candlestick pattern on Aluminium daily chart

Aluminium is witnessing 3 black crows candlestick pattern on daily chart along with bearish divergence on stochastic attracting more bears to jump in.

Dark Cloud Cover on ZINC chart check the detail

Zinc settled with a dark cloud cover bearish reversal candlestick pattern along with overbought reading on stochastic that may prevent further bulls to jump in.

Crude oil Engulf Pattern on the chart read full detail

Crude oil settled just near the 10 days SMA engulfing previous day’s trading range. Showing some weakness in this counter.

Aluminium view according to chart

Aluminum April contract settled at 110.20 down by 1.75 Rupees. Existence of Bearish harami at the top of move dragged down prices and metal headed an intraday low of 109.50 which was also supported by 10 days SMA and horizontal support line.

Nickel Reversal possible according to chart

Nickel is witnessing a double top near the areas of 1002 and settled with a BEARISH HARAMI candlestick pattern on daily chart.

Copper Bearish Engulfing Patter on Daily Chart

Copper failed to clear main hurdle of 409 and settled with a bearish engulfing candlestick pattern.

Copper view bullish harami on daily chart

Copper settled well with in the range of prior session and with a bullish candle that qualifies as a bullish harami candlestick pattern.

FOMC Member Dudley Speaks

Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy.

Zinc Technical View according to chart

Zinc March contract inched 1.35 rupees up to settle at 128.70 this week. As we can see in chart provided above zinc has formed a valid breakout above 5 years old resistance of 123.20 and has been holding above the same.

Bearish Harami on Silver Daily Chart

Yesterday silver closed with a bearish harami candlestick formation that indicates possible trend reversal to the down side.

Nickel Weekly Technical outlook

Nickel has been settled well above 10 weeks SMA for 3 consecutive weeks hinting returning buying interest in this commodity. 10 weeks SMA has crossed above 20 weeks SMA and 20 weeks SMA is also above 50 weeks SMA hinting bullish trend on short term and long term time frames.

Copper technical view (Doji on Daily Chart)

Copper closed well with a doji candlestick formation indicating a state of indecision around 50 days SMA line.

Silver Weekly Technical View 17 to 21 feb

Silver traded with bullish bias and settled nearer 50 weeks SMA. 10 weeks SMA is still below 20 weeks SMA but now moving towards 20 weeks SMA indicating bullish developments on short term time frame.

ZINC Technical Weekly Outlook

Zinc is getting good support near horizontal line and 20 weeks SMA and nicely jumped after hitting a low of 121.90 this week.

Natural Gas Shooting Star On daily chart

Natural gas headed a high of 359.40 but couldn’t hold the gains above the same and closed well below its opening price by making it a shooting star candlestick formation.

Silver Technical Outlook for short term trader

Silver closed well below key support of 43300 and witnessing a bearish flag pattern breakdown that may extend current down move towards 41500 zones.

What is CB Consumer Confidence?

Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

Natural Gas Technical View for short term traders.

Natural gas Technical View On Charts for short term / long term trader. Follow recommendation with strict stop loss.

Lead Technical Outlook on chart

Lead trading range for the day is expected among the key support at 132 and resistance at 138.

Crude oil Weekly View According to Chart

What to do in Crude oil this week? Check On charts.

Copper Technical View watch on chart

Trading range for the day is expected among the key support at 455 and resistance at 464.

What is ADP Non-Farm Employment Change?

Do u know about ADP Non-Farm Employment Change?

Types of Orders for trading

The system allows the trading members to enter orders with various conditions attached to them as per their requirements. These conditions are broadly divided into the following categories. • Time conditions • Price conditions • Other conditions Several combinations of the above are allowed thereby providing enormous flexibility to the users. The order types and conditions are summarized below.

Growth Drivers of Derivatives

Over the last three decades, the derivatives market has seen a phenomenal growth. A large variety of derivative contracts have been launched at exchanges across the world. Some of the factors driving the growth of financial derivatives are:

Natural Gas Technical view on Inventory Data

Natural gas is getting good support near 20 days SMA and buying interest coming in this commodity near this line.

Information about Consumer Confidence.

Consumer confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity, that is importance for currency.

Economic Variables Impacting Exchange Rate Movement

Various economic variables impact the movement in exchange rates. Interest rates, inflation figures, GDP are the main variables; however other economic indicators that provide direction regarding the state of the economy also have a significant impact on the movement of a currency. These would include employment reports, balance of payment figures, manufacturing indices, consumer prices and retail sales amongst others. Indicators which suggest that the economy is strengthening are positively correlated with a strong currency and would result in the currency strengthening and vice versa.

Major Currencies of the world

The US Dollar is by far the most widely traded currency. In part, the widespread use of the US Dollar reflects its substantial international role as “investment” currency in many capital markets, “reserve” currency held by many central banks, “transaction” currency in many international commodity markets, “invoice” currency in many contracts, and “intervention” currency employed by monetary authorities in market operations to influence their own exchange rates.

Do you know about Unemployment claims data.

Unemployment claims data is generally a lagging indicator, the number of unemployed person is an important signal of economic health.

Core Durable Goods Orders

Core Durable Goods Orders economic data from US released by Cencus Bureau.

Crude Oil Technical View for Intraday

Crude oil is showing a good move after expiry of prior contract and hinting some bullishness in coming days.

Speculation and Hedging

Speculators are those who do not have any position on which they enter in futures and options market. They only have a particular view on the market, stock, commodity etc. In short, speculators put their money at risk in the hope of profiting from an anticipated price change. They consider various factors such as demand and supply, market positions, open interests, economic fundamentals and other data to take their positions.

German Ifo Business Climate

IFO data is widely followed as an early indicator of the state of the German economy.

Natural Gas Weekly Outlook

Natural Gas drops from 2 year high on mixed weather forecast outlook from us.

Margins for trading in futures

Margin is the deposit money that needs to be paid to buy or sell each contract. The margin required for a futures contract is better described as performance bond or good faith money. The margin levels are set by the exchanges based on volatility (market conditions) and can be changed at any time. The margin requirements for most futures contracts range from 2% to 15% of the value of the contract.

PPI m/m (US Data)

PPI Data is a leading indicator of consumer inflation. Traders must know about this data whenever it is releasing.

Zinc Technical View on Daily Chart.

Zinc is the most attractive metal among base metal pack and witnessed a nice rally for 2nd consecutive day.

China Industrial Production Data

Chinese Industrial Production data is a leading indicator for economic health. It is also called Industrial Output.

Factors Driving the Growth of Derivatives

Over the last three decades, the derivatives market has seen a phenomenal growth. A large variety of derivative contracts have been launched at exchanges across the world. Some of the factors driving the growth of financial derivatives are:

Technical View On Nickel.

Nickel Dec Trading slightly up on Friday ahead on U.S. Jobs Data.

Gold Technical View on Chart

The ECB monthly meeting is on Thursday and the U.S. Unemployment Claims data is on Friday. Both are the biggest ones of the week for the markets.

Spanish Unemployment Change

The Spanish Unemployment Change Data shows the change in the number of unemployment people during the previous month.

Fed Bernanke Speaks

Fed ben Bernanke is the chairman of Fedral reserve. Head of the central bank, which controls short term interest rates.

Stock Quote – Lifeline of an investor

Stock quote is that magical figure that gives you all the information related to stock Stock quotes can be obtained in newspapers and online but the most convenient place is online as it is very close to real time information. There are many websites which help you to get real-time quotes at a mouse click. Different sources provide different sets of information.

CPI Flash Estimate y/y

A consumer price index (CPI) data is based on the changes in the price level of consumer goods and services purchases by household.

Volatility of Stock Markets and its causes

Volatility is one of the best phenomenon without which stock markets will loose its charm. It is the tendency of fluctuation of market indices over a period of time; more is the fluctuation, higher is the volatility. The ups and downs of stock prices is what that adds spice to the market behaviour. This see-sawing effect has its own implications, both good and bad. Good, because prudent investors taking advantage buy on dips and sell on highs for profit booking. On the flip side, greater volatility lowers investor’s confidence in the market prompting them to transfer their investment in less risky options due to unexpected market behavior.

Crude Oil Technical Report

Crude traded with mixed bias this week ahead of weekly Inventory from US.

Pending Home Sales

Pending Home Sales data can help investors to keep a finger on the pulse of the economy. That will help to understand the demand for housing.

German Ifo Business Climate

IFO Data is based on surveyed builders, manufacturers, retailers and wholesalers.

HSBC Flash Manufacturing PMI

Markit Economics provide the HSBC Flash Manufacturing PMI data. It is an independent, global provider of some of the world’s most influential business surveys.

Retail Sales

Retail Sales Data is highly important for the economy.

Core CPI

CPI data is very importat for traders. Traders have to keep in mind about this data before trading or invest in market because its impact on inflation.

Settlements of Futures contracts

Future contracts have two types of settlements, the Mark to Market (MTM) settlement which happens on a continuous basis at the end of each day, and the final settlement which happens on the last trading day of the futures contract. On the NCDEX, daily MTM settlement and final MTM settlement in respect of admitted deals in futures contracts are cash settled by debiting/crediting the clearing accounts of CMs with the respective clearing bank. All positions of a CM, either brought forward, created during the day or closed out during the day, are marked to market at the daily settlement price or the final settlement price at the close of trading hours on a day.

German ZEW Economic Sentiment

German ZEW Economic Sentiment data is Important for European market.

About NCDEX Spot Exchange Ltd. (NSPOT)

NSPOT is a delivery based transparent,real time, online spot exchange of the country. It is established as per the guidelines of Ministry of Consumer Affairs, Government of India. NSPOT is a wholly owned subsidiary of NCDEX which is the leading Indian Agriculture Commodity Derivatives Exchange. NCDEX SPOT derives its strength from its parent organization (i.e. NCDEX) in creating and managing electronic online trading along with the concomitant risk management system, clearing and delivery process whoch will immensely contribute building an active, liquid and a vibrant spot price delivery platform for agri as well as non-agri commodities at country level and also be a bench mark for pricing.

Crude Oil

Weekly changes in the number of barrels of crude oil held in inventory by commercial firms during the past.

Hedging

Many participants in the commodity futures market are hedgers. They use the futures market to reduce a particular risk that they face. This risk might relate to the price of wheat or oil or any other commodity that the person deals in. The classic hedging example is that of wheat farmer who wants to hedge the risk of fluctuations in the price of wheat around the time that his corp is ready for harvesting by selling his corp forward, he obtains a hedge by locking to a predetermined price

Nickel Technical Report

Nickel trading range for the day is expected support at 840 and resistance at 910.

Forwards contracts in derivatives

In recent years, derivatives have become increasingly popular due to their applications for hedging, speculation and arbitraging. While futures and options are now actively traded on many Exchanges, forward contracts are popular on the OTC market. A forward contract is an agreement to buy or sell an asset on a specified date for a specified price. One of the parties to the contract assumes a long position and agrees to buy the underlying asset on a certain specified future date for a certain specified price. The other party assumes a short position and agrees to sell the asset on the same date for the same price. Other contract details like delivery date, price and quantity are negotiated bilaterally by the parties to the contract. The forward contracts are normally traded outside the exchanges.

Crude Oil Weekly Outlook

Finally crude closed with a positive note after 9 weeks of decline in a row.

Commodities traded on NCDEX

NCDEX gives priority to commodities that are most relevant to India, and where the price discovery process takes place domestically. The products chosen are based on certain criteria such as price volatility, share in GDP, Correlation with global markets, share in external trade, warehousing facilities, traders distribution, geographical spread, varieties etc. List of commodities offered for futures trading on NCDEX are given below

Spot Price and polling in commodity exchange

Like any other derivative a futures contract derives its value from the underlying commodity. The spot and futures market are closely interlinked with price and sentiment in one market affecting the price and sentiment in the other. Fair and transparent spot price discovery attains importance when studied against the role it plays in a futures market.

Shareholders of NCDEX and its products

NCDEX is promoted by a consortium of four institutions. These are National Stock Exchange (NSE), ICICI Bank, Life Insurance Corporation of India (LIC) and National Board for Agriculture and Rural Development (NABARD). Later on their shares were diluted and more institutions became shareholders of NCDEX. These are Canara Bank, CRISIL Limited, Indian Farmers Fertilizers Cooperative Limited (IFFCO), Punjab National Bank (PNB), Goldman Sachs, Intercontinental Exchange (ICE) and Shree Renuka Sugars Ltd.

Difference between Commodity and Financial Derivatives

The basic concept of a derivative contract remains the same whether the underlying happens to be a commodity or a financial asset. However, there are some features which are very peculiar to commodity derivative markets. In the case of financial derivatives, most of these contracts are cash settled. Since financial assets are not bulky, they do not need special facility for storage, transport even in case of physical settlement. On the other hand, due to the bulky nature and physically existence of the underlying assets, physical settlement in commodity derivatives creates the need for warehousing.

Some commonly used Derivatives

Here we define some of the more popularly used derivative contracts. Forwards : A forward contract is an agreement between two entities to buy or sell the underlying asset at a future date, at today’s pre-agreed price. Futures : A future contract is an agreement between two parties to buy or sell the underlying asset at a future date at today’s future price. Futures contracts differ from forward contracts in the sense that they are standardized and exchange traded

Ratio Analysis

Financial ratio analysis is the calculation and comparison of ratios which are derived from the information in a company’s financial statements. The level and historical trends of these ratios can be used to make inferences about a company’s financial condition, its operations and attractiveness as an investment.

Trading in Circuit Limits

The major stock and commodities exchanges have instituted procedures to limit mass or panic selling in times of serious market declines and volatility. These mechanisms are known as Circuit Breakers, the Collar Rule, and Price Limits. Circuit Breakers establish whether trading will be halted temporarily or stopped entirely. The collar Rule and Price Limits affect the way trading in the securities and futures markets takes place

Spot Vs Forward Transaction

Every transaction has three components – trading, clearing and settlement. A buyer and seller come together, negotiate and arrive at a price. This is trading. Clearing involves finding out the net outstanding, that is exactly how much of goods and money the two should exchange.

Direct Payout to Investors

NSCCL has introduced the facility of direct payout (i.e. direct delivery of securities) to clients’ account on both the depositories. IT ascertains from each clearing member, the beneficiary account details of their respective clients who are due to receive pay out of securities. Based on the information received from members, the clearing corporation sends payout instructions to the depositories, so that the client receives the payout to the extent of instructions received from the respective clearing members. To the extent of instructions not received, the securities are credited to the CM pool account of the member. Following are the salient features of ‘Direct Payout ’to investors.

Market Types in Equity Segment

The Capital Market system has four types of market: 1. Normal Market : Normal market consists of various book types in which orders are segregated as Regular Lot Orders, Special Term Orders, and Stop Loss Orders depending on the order attributes. 2. Auction Market : In the auction market, auctions are initiated by the exchange on behalf of trading members for settlement related reasons. The main reasons are shortages, bad deliveries and objections. There are three types of participants in the auction market. (A) Initiator: The Party who initiates the auction process is called an initiator. (B) Competitor: The party who enters on the same side as of the initiator is called a competitor (C) Solicitor: The party who enters on the opposite side as of the initiator is called a solicitor.

Investor Services Cell and Arbitration

Investor Service Cell (ISC) handles the investor’s complaints against the trading members / companies in respect of claims/disputes for transactions executed on the Exchange. The complaints are forwarded to the trading members for resolution and seeking clarifications. The ISC follows-up with the trading members and makes efforts to resolve the complaint expeditiously. In certain cases, on account of conflicting claims made by the investor and the trading member, when it is not possible to administratively resolve the complaint, investors are advised to take recourse to the arbitration mechanism prescribed by the Exchange.

Declaration of Defaulter by SEBI or Exchange

Trading members of the Exchange can appoint authorized person in the Capital Market, Futures and Options and Currency Derivatives Segments. After received application from individuals / companies Exchange authorized the person and provide him membership once all the formalities completed A Trading member may be declared a defaulter by direction / circulation / notification of the relevant authority of the trading segment if

Block Trading Session of Stock Market

The Exchange has introduced a separate trading session for the block trades from November 14, 2005. In this session, trading is conducted in the Odd Lot market (market type ‘O’) with book type ‘OL’ and series ‘BL’. It is a 35 minute market; i.e. the trading window shall normally remain open from 9:15 hours to 9:50 hours. There is no pre-open and post close in the block trade session. For a block trade, order should be of a minimum quantity of 5,00,000 shares or minimum value of Rs. 5 crore which ever is lower.

Trade Management in Stock Market

A Trade is an activity in which a buy and sell order match with each other. Matching of two orders is done automatically by the system. Whenever a trade takes place, the system sends a trade confirmation message to each of the users involved in the trade. The trade confirmation slip gets printed at the trader workstation of the user with a unique trade number. The system also broadcasts a message to the entire market through the ticker window displaying the details of the trade. Before the trade is effected, the system performs checks with respect to the following parameters:

The Benefits of Long term Investments

While short term investing may give investors some thrills and even deliver gains, long-term investors have a many benefit from: • Dividends: Companies usually pay dividends to their shareholders those keep hold into their companies share for long term which increase the value of their investments. Some companies reinvest dividends with additional share purchases and increase the value of your investment further. • Escape from price fluctuations: Investments for long tenure escapes from price fluctuations for any point of time. During the short-term investments, all sorts of events

NCDEX Trading Platform

National Commodity and Derivatives Exchange Ltd. (NCDEX) is a technology driven commodity exchange. It is a public limited company registered under the Companies Act, 1956. It has been launched to provide a world-class commodity exchange platform for market participants to trade in a wide spectrum of commodity derivatives driven by best global practices, professionalism and transparency. NCDEX is regulated by Forward Markets Commission in respect of futures trading in commodities. NCDEX currently facilitates trading of various commodities – gold, silver, base matels, and many agri products.

What are Options in stock market?

An option is a contract which gives the buyer the right, but not the obligation to buy or sell shares of the underlying security at a specific price on or before a specific date. “Option” as the word suggests, is a choice given to investor to either honors the contract, or if he chooses exits from the contract. There are two kinds of options: Call Option and Put Options.

Clearing And Settlement in Stock Market

The clearing and settlement mechanism in Indian Securities market has witnessed significant changes and several innovations during last decade. These include use of the state-of-art information technology, emergence of clearing corporations to assume counter party risk, shorter settlement cycle, dematerialize and electronic transfer of securities, fine tuned risk management system.

Methods of buying and selling of shares

Market Orders : When you put buy or sell price at market rate then the price get executed at the current rate in the market. The market order gets immediately executed at the current available price. In market order there is no need to mention the price, the transaction will get executed at the best current available price.

What is Short Selling?

Short selling means selling the securities which you didn't buy at all. The term short here signifies that you do not hold the securities being sold. The first thought strikes up would be – where do these shares come from which you are going to sell without possessing them in your account.

What is inactive and active share?

Active shares are those in which transactions take place every day, or almost every day on the stock exchange. At the other extreme are shares in which transactions take place rarely, once in while called inactive shares moreover an inactive share has been defined as one, which is transacted less than two times a month in any stock exchange.

Functions of SEBI

In India Securities Exchange Board of India (SEBI) has been established by Indian Government in 1998 and given statutory powers for the purpose of to protect the interest of the investors and to promote development and regulate the stock market.

About National Stock Exchange (NSE)

There are two major stock exchanges in India named Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) situated in Mumbai, India both are responsible for majority of share transactions. NSE is mutually owned by a set of leading banks, financial institutions, insurance companies and other financial intermediaries in India but its ownership and management operate as separate entities.

What is IPO

An initial public offering (IPO) or stock market launch is a type of public offering where shares of stock in a company are sold to the general public, on a securities exchange for the first time. Through this process, a private company transforms into a public company. Initial public offerings are used by companies to raise expansion capital for business requirements.

Trading in Commodity Market as per current scenario

Commodity market behaves as per economical situations and changes in country. As per the market experts investments in commodities provides the shield against inflation because if inflation increases, the prices of commodity will also increase. However monsoon is very good in this year therefore expectation of more profit in commodities agri products and due to disturbance in Syria, the crude oil price can be expected to high, gold is also touches it’s new high due to major movements in currency market.

Commodity Futures trading

In India there is a controller under ministry of consumer affairs known as Forward Market Commission (FMC) for better management and transparency in trading of different commodities. FMC have given permissions to different national and regional stock exchanges for future trading of all listed commodities. The purpose for establishment of these exchanges is to get the fair and actual prices of different products and minimize the risk of exporters, traders and also helps the farmers.

Who will inherit the shares?

At the time of opening a Demat account for trading in shares, you should be ensure to give the details of nominee to whom shares will be transferred in case of account holder death. His/her heir not entitled to get the shares transferred into their names if not mentioned as nominee, the shares will go to those nominee whom details updated in the Demat account.

Investments in Government Bonds

The initiates taken by RBI to stop the falling of Rupees value against the Dollar this resulting the effects on low liquidity in the system and arising the Rate of Interest. To overcome from this situation and managing the proper liquidity for proper flow and availability of funds to production industries, Central Bank has planned for purchasing the Govt. Bonds of 8000 Crore from options open market.

Intraday Trading

Day trading means buy/selling of shares and off setting the positions on same day. Day trading serves the purpose of bringing the liquidity to market and they help the market movement, more then 80% of the volume of stock market comes from day trading after introduction of derivative market and advanced trading techniques had made the day trading to grow the market more.

Facts and remedies for Falling down of Rupee value in international market

Since couple of months back Indian Rupee has fallen so much. Everybody is worried for this fallen and wants to know how much it will fall further. Indian Govt. has taken up various measures to control the falling of Rupee value but all efforts going in vain. The foreign flows of money are going from India frequently due to which Rupee value has fallen 65 against the Dollar$. Decreasing Rupees value creates inflation in country certainly. To control the inflation is the biggest challenge before Indian economy.

Hedging the Safeguard of Investments

Hedging is the technique which reduces the investment risks of investors in stock market. The work done through counter balancing means another investment to hedge the risk of previous investment, in other words hedging the investment in different investment options those are having different approach. This need to be remembering there are some value for each hedge which have to be paid by investors, traders if market moves negative moreover hedging strategies can be wrong as it’s not a complete science.

Body and body parts of Candles formed in candlestick charts

Body of candles is like a candle with a stick on top and bottom of the candle, with a open, low, close, high, upper shadow and bottom shadow, like it appears in below image:

New Home sales

New home sales measures the number of newly constructed homes with a committed sale during

Arbitrage Funds and it's Benefits

Price movement (upward and downward) of share market is the process of the market. But how do you feel if you can make profit in price movement? Arbitrage funds takes the benefits in price differences in two different stock exchanges, these funds works only on single principle i.e. to sell the securities in different markets so that can make maximum profit and lower the risk.

What are Candlestick Charts and how they help in Technical Analysis

Introduction to Candlesticks History: In 17th century Japanese began using technical analysis to trade in the commodity of rice. This version of analysis was different from the US version initiated by Charles Dow around 1900, many of the guiding principles were very similar:

Consumer Sentiment

The University of Michigan’s consumer survey center has questioned across 500 different households each month of their financial conditions and attitudes about economy. Consumer sentiment is directly related to the strength of consumers spending; consumer’s confidence and consumer sentiments are two ways of talking about consumers attitudes.

Retail Sales and its impact on Commodity market

Retail sales measures the total receipts at stores that sell merchandise and related services to final consumers. Sales are by retail and food services stores. Data are collected from the monthly retail trade survey conducted by the US Bureau of the census. Essentially the retail sale covers the durable and non-durables portions of consumer spending.

Types of charts in Technical Analysis study

Technical Analysis on stocks and commodities is based on chart analysis. Charts are made through history data of price and volume of securities. Different types of charts available for study of technical analysis are:

Chart Analysis in Technical Analysis of stocks and commodity

Technical analysis of securities could be as complex or as simple as we make it. The below said example will explain it in a simplified version. If our interest is in buying stocks, than our focus should be on spotting bullish situations.

Currency futures and its benefits

Currency futures are introduced in India in 2008. The opening of the currency derivatives in India was a revolution in the domestic financial markets. The currency exchange in India is rising day on day only because by increased awareness about the trade among all market players, base of forex market is based on USD-INR futures

EIA Petroleum Status Report

The Energy information administration (EIA) publishes weekly information, reports on Petroleum inventories in the US, weather produced in USA or in rest of the world. The level of inventories helps determine prices for petroleum products

Jobless Claims Data

Jobless claims data is a major data that releases in United States of America. A jobless claims are made by those people who are unemployed. New unemployed claims are compiled weekly to show the number of individuals who have filed for unemployment insurance for the first time.

Non farm payroll data impact on commodity market

Non farm payroll data is related to people who engaged in the activity other than farming. Non farm payroll measures the change in the number of peoples employed during the previous month, excluding the farming industry. Job creation is the major indicator of consumer spending in which account for the majority of economic activity

Inflation

Inflation is defined as a sustained increase in the general level of prices for goods and services. It is calculated as an annual percentage increase. Inflation is now the biggest concern before Indian Economy. All the actions taken by the Indian Govt. are not sufficient to control the inflation.

RBI role in indian financial market

Reserve Bank of India (RBI) is the supreme authority of Indian financial market. so whatever RBI does it is very important for the indian market. RBI Regulates all the financial actions of banking sectors. RBI decides the interest rate, bank rate, repo rate, SLR ratio etc.

GDP role in economy and stock market

Gross Domestic Product (GDP) is defined as the total production of goods and services within the country in a financial year.

Technical Analysis Syllabus contents

Technical Analysis is a study of charts, indicators, patterns and theories based on history prices and volume of stocks and commodity. Contents of Technical Analysis for study are:

About Distance Education

Distance education or E-learning is a mode of delivering education and instruction often on an individual basis to learner who are not able to physically present in a traditional sitting such as classroom sessions. Distance learning provides "Access to learning when the source of information and the learners are separated by time distance or both". tools,programs and know about new technologies without any other additional cost.

How to Read the Stock Market?

Want to find how to get signals in Future and Options market, want to know the trend in which the stock market and the individual stocks are likely to move in the short period.

What is Derivative and How to trade in Derivatives

Derivative means a forward, future, option or any other hybrid contract of pre determined fixed duration, linked for the purpose of contract fulfillment to the value of a specified real or financial asset or to an index of securities.

Indicators in Technical Analysis

Indicators are used to analyze change in some technical matrix viz. Price, Volume, Volatility or Breadth the basis of some predefined parameters.

Suggestions and Risk Management Strategies while trading

Suggestions and risk management strategies while trading in stock market and commodity market. Dos and donts in stock market.

What is Altman Z- SCORE?

What is Altman Z SCORE? Edward I. Altman published Altman Z score formula in 1968 for predicting bankruptcy of banks. The formula is used to predict the probability that a firm will go into bankruptcy within two years time horizon. Z-scores are used to predict corporate defaults and an easy-to-calculate control measure for the financial distress status of companies.

Charting Pattern Double Top and Double Bottom

Double Top appears on a chart in the shape of the letter "M" and are quite common. The double top pattern is found at the peaks of an upward trend and is a clear signal that the preceding upward trend is weakening and that buyers are losing interest.

Join Us Today

The Ultimate E-Learning Destination

Start learning by registering for free